Generate Monthly Income with an Investment in Childcare

Fund Overview

The Finexia Childcare Income Fund, launched in October 2022, a social impacting investment opportunity designed to support the growth of the childcare sector. This unique fund specialises in providing transitional funding to experienced childcare operators during the critical ramp-up period of newly opened or reopened centres. With a strategic focus on helping these centres reach a sustainable operational capacity — typically around 80% within the first year — the fund plays a crucial role in facilitating subsequent bank financing.

Offering an impressive annualised monthly return of 10% as of August 2, 2024, the Finexia Childcare Income Fund presents an attractive risk-return profile for investors. Our loans, primarily issued for a 12-month term, are meticulously managed to ensure the highest quality and contribute to the robust performance of the fund.

Beyond financial returns, the fund serves as a vital non-bank lending source in the childcare segment, benefiting from strong market dynamics and resilient business models that are largely unaffected by economic cycles. This distinct approach not only underscores our commitment to fostering growth in this essential sector but also positions the fund as an excellent tool for diversification within a portfolio.

The fund, externally rated by SQM and awarded a "VERY STRONG" rating from Foresight Analytics & Ratings, shows high confidence in delivering risk-adjusted returns, in line with Finexia's investment objectives.

This confidence is backed by our experienced and well-resourced management team, dedicated to supporting the evolving landscape of non-bank lending in Australia.

Why Invest In the Childcare Income Fund

Childcare Income Fund Performance

PAID MONTHLY

NET OF FEES

ABOVE RBA CASH RATE

OF 4.10%

It's important to note that past results don't guarantee future outcomes. The income generated is contingent on the success of the investments, and the responsible entity has the discretion to determine these payments.

The returns from the fund are presented net of all fees and are denominated in AUD. The calculations are derived from exit prices, factoring in ongoing fees and costs. It's assumed that distributions are not reinvested through the Distribution Reinvestment Plan (DRP). Taxes haven't been considered in these calculations.

The RBA Cash Rate stands at 410 basis points per annum.

Who is the Childcare Income fund for?

Social Impact "ESG"

Investors who are keen on contributing to societal benefits, such as supporting childcare services, may be drawn to this fund.

Diversification

Fee-conscious Investors

10% pa Stable and Predictable Returns paid monthly

Long-term Growth Potential

Low Volatility Investment

Childcare Income Fund Ratings:

Childcare Income Fund Research Reports:

How to Invest

Learn More

SPEAK TO OUR INVESTMENT MANAGER

To invest in the Finexia Childcare Incomefund it starts with a call with our investment manager. He will answer any question you still might have and give you insights into how the investment works. Click below to book a call

Request More Information

PDS & TMD TO YOUR INBOX

We need to ensure you're a good fit for our product. Invest in the Childcare Income Fund in just 10-15 minutes with our online application. Click below to start. Our investment manager is here to help.

Childcare Investment Newsletter

JOIN OUR MAIL LIST

We have an investor specific monthly childcare e-newsletter. This e-newsletter covers, childcare investments, childcare sales, Childcare Fund updates, relevant childcare industry updates, childcare development opportunities and more

Prior to applying for units within the Fund, it's essential to review the Product Disclosure Statement (PDS), the Additional Information Booklet, and the Target Market Determination (TMD).

Fill out the form below to get started

At Finexia, we want to ensure that you are a good fit for the Childcare Income Fund. A Product Disclosure Statement (PDS) will be provided to you in due course.

Childcare Income Fund Documents:

Fill out the form below to get started

At Finexia, we want to ensure that you are a good fit for the Childcare Income Fund. A Product Disclosure Statement (PDS) will be provided to you in due course.

Fill out the form below to get started

At Finexia, we want to ensure that you are a good fit for the Childcare Income Fund. A Product Disclosure Statement (PDS) will be provided to you in due course.

Childcare Income Fund Forms:

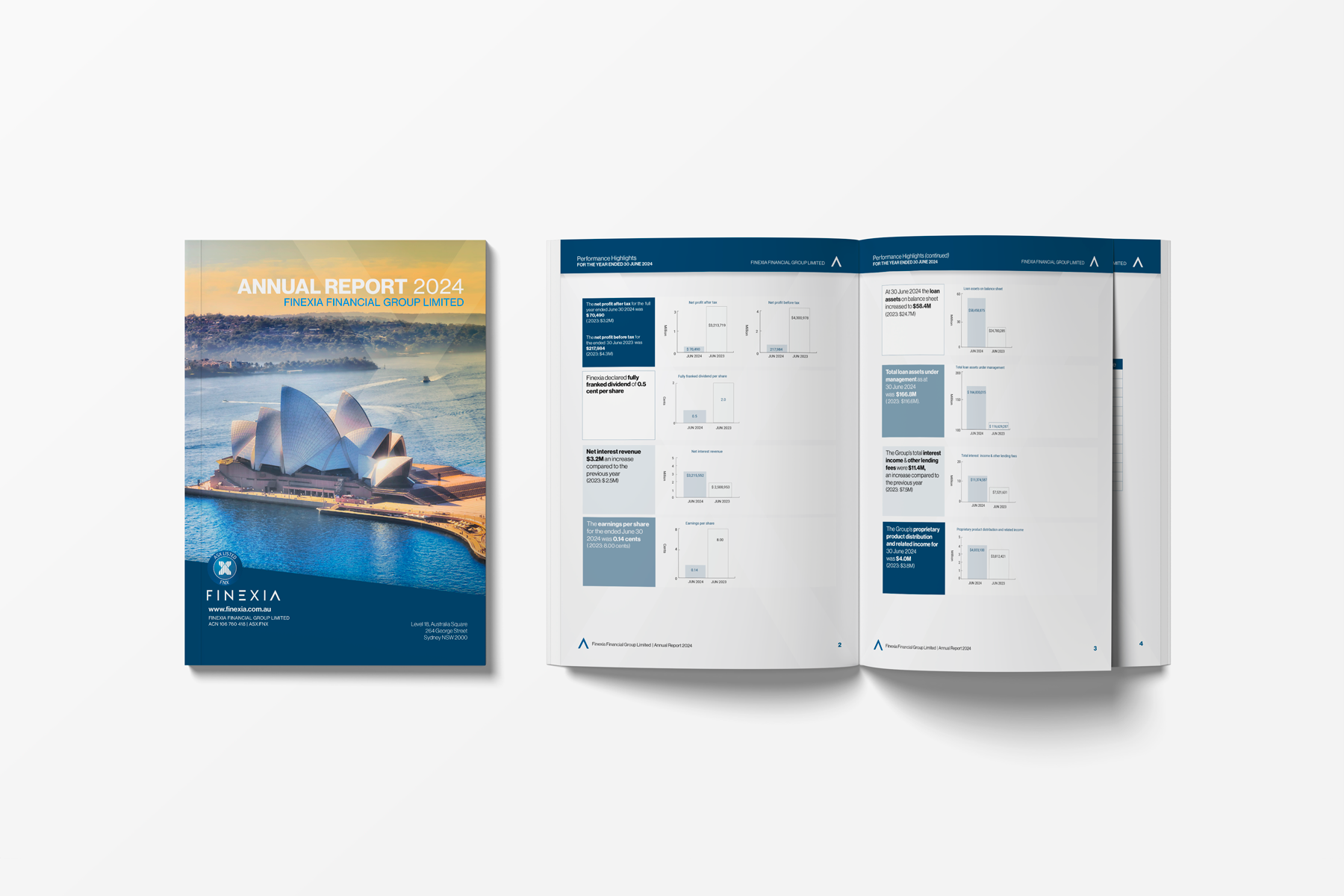

Finexia - Financial Reports:

Additional Information:

CLICK TO EXPAND

Other Information:

CLICK TO EXPAND

)

)

)