)

A Comprehensive Guide to Choosing the Ideal Managed Fund for Your Investment Portfolio

Introduction to Managed Funds

Managed funds are investment vehicles where a professional fund manager pools the money of multiple investors to create a diverse portfolio. This pooling of resources enables investors to access a broad range of investments that may not be feasible for an individual investor. Managed funds can invest in various assets, including stocks, bonds, property, and cash.

Managed Funds vs. ETFs

Managed funds and exchange-traded funds (ETFs) are both popular investment options. The key differences between them are:

Table of Contents

- Introduction to Managed Funds

- Managed Funds vs. ETFs

- Types of Managed Funds

- Factors to Consider When Choosing a Managed Fund

- Assessing Fund Performance

- Evaluating Fund Managers

- Costs and Fees

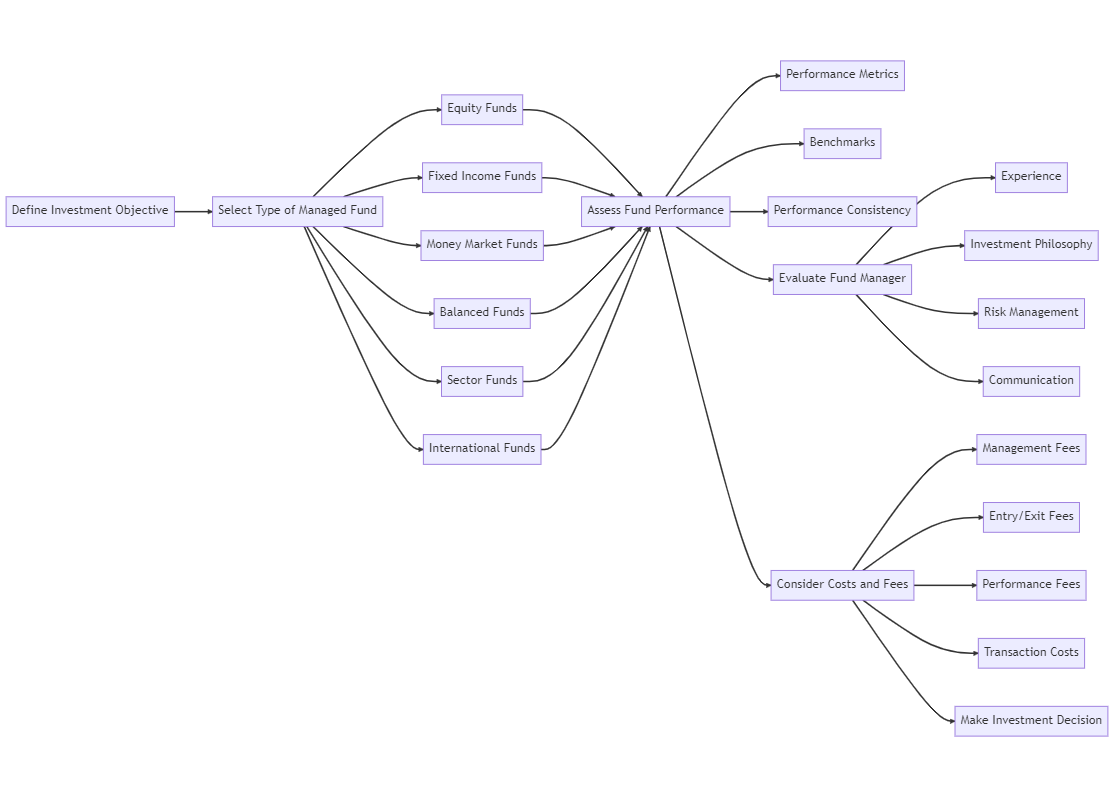

- Diagram: Choosing the Right Managed Fund

- Conclusion

- Management: Managed funds are actively managed by a fund manager, while ETFs are typically passively managed, tracking an index.

- Trading: Managed funds are bought and sold at the end of the trading day at the net asset value (NAV) price, while ETFs are traded throughout the day on a stock exchange at market prices.

- Fees: Managed funds tend to have higher fees due to active management, while ETFs usually have lower fees due to passive management.

Types of Managed Funds

There are several types of managed funds, each with different investment objectives and strategies. Some common types include:

- Equity Funds: Invest in a variety of stocks to achieve capital growth.

- Fixed Income Funds: Focus on bonds and other fixed-income securities to generate regular income.

- Money Market Funds: Invest in short-term, high-quality debt instruments for capital preservation and income generation.

- Balanced Funds: Combine stocks, bonds, and cash to balance growth and income potential.

- Sector Funds: Concentrate on specific industries or sectors, such as technology, healthcare, or utilities.

- International Funds: Invest in companies outside the investor's home country for global diversification.

Factors to Consider When Choosing a Managed Fund

When selecting a managed fund, consider the following factors:

- Investment Objective: Ensure the fund's investment objective aligns with your financial goals and risk tolerance.

- Fund Performance: Analyze the fund's historical performance and benchmark comparisons.

- Fund Manager: Evaluate the fund manager's experience, investment style, and track record.

- Costs and Fees: Understand the total costs, including management fees, transaction costs, and taxes.

Assessing Fund Performance

To assess a managed fund's performance, consider the following:

- Performance Metrics: Examine metrics such as total return, risk-adjusted return, and annualized return.

- Benchmarks: Compare the fund's performance to relevant benchmarks, such as market indexes or peer group averages.

- Performance Consistency: Review the fund's performance consistency over different time periods to determine its ability to deliver steady returns.

Evaluating Fund Managers

To evaluate a fund manager, consider their:

- Experience: A fund manager with a solid track record of managing similar funds is more likely to deliver positive results.

- Investment Philosophy: Understand the fund manager's investment approach, including their focus on fundamental analysis, technical analysis, or a combination of both.

- Risk Management: Assess the fund manager's risk management strategies and how they align with your risk tolerance.

- Communication: Consider the fund manager's transparency and communication with investors, which can be crucial in understanding their investment decisions.

Costs and Fees

Costs and fees associated with managed funds can impact your overall investment returns. Some common fees to consider include:

- Management Fees: These are ongoing fees charged by the fund manager for managing the portfolio.

- Entry/Exit Fees: These are one-time fees charged when you buy or sell units in a managed fund.

- Performance Fees: Some fund managers charge a performance fee based on the fund's returns, typically when it outperforms a benchmark.

- Transaction Costs: These costs include brokerage fees, taxes, and other expenses associated with buying and selling securities within the fund.

Diagram: Choosing the Right Managed Fund

Conclusion

Choosing the right managed fund for your investment portfolio requires thorough research and careful consideration of various factors, including investment objectives, fund performance, fund manager qualifications, and associated costs and fees. By evaluating these factors and aligning them with your financial goals and risk tolerance, you can select a managed fund that best suits your investment needs and helps you achieve your long-term financial objectives.

)

)

)

)

)

)

)

)

)

)

)

)