)

Childcare: A Focus for Commercial Investors

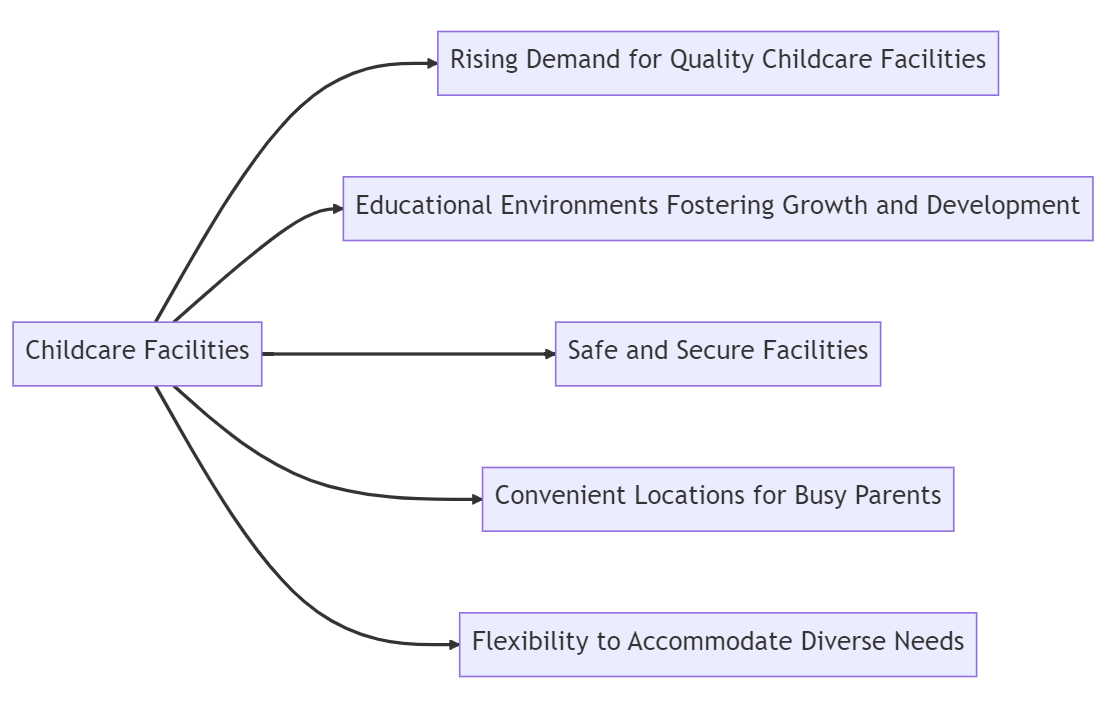

In commercial real estate, childcare has emerged as a highly sought-after investment opportunity. With increasing demand for quality early childhood education and care, commercial investors are turning their attention to sub-$5 million assets dedicated to childcare. In this comprehensive article, we explore the key factors that make childcare facilities an attractive investment and delve into the specific aspects that commercial investors should consider when venturing into this thriving market.

1. Rising Demand for Quality Childcare Facilities

The demand for quality childcare facilities has experienced significant growth in recent years. Working parents, recognizing the importance of early education and nurturing environments for their children, are actively seeking reputable and reliable childcare options. As a result, commercial investors who tap into this demand have the opportunity to provide a valuable service while reaping substantial financial rewards.

2. Educational Environments Fostering Growth and Development

Childcare facilities that prioritize educational programs and offer stimulating environments for children are highly sought after by discerning parents. Investing in sub-$5 million assets that incorporate innovative teaching methodologies, age-appropriate learning materials, and engaging play areas can significantly increase the appeal of these facilities.

By partnering with experienced early childhood educators and employing a well-rounded curriculum, commercial investors can position their childcare assets as trusted institutions that prioritize the holistic development of children. This focus on educational excellence sets these facilities apart from competitors and appeals to parents who value their child's educational journey.

3. Safe and Secure Facilities

Safety is of paramount importance when it comes to childcare facilities. Commercial investors should prioritize assets that meet stringent safety standards, including secure premises, childproof infrastructure, and well-trained staff. A strong emphasis on child safety and security not only reassures parents but also enhances the reputation and marketability of the childcare facility.

4. Convenient Locations for Busy Parents

Choosing sub-$5 million childcare assets located in convenient and accessible areas is crucial to attract busy parents. Facilities situated in close proximity to residential areas, major transportation hubs, or corporate districts have a competitive advantage. Easy access and proximity to parents' workplaces reduce commuting time and offer convenience, making these childcare facilities an attractive choice for time-constrained families.

5. Flexibility to Accommodate Diverse Needs

Flexibility in childcare services is a key consideration for commercial investors. Assets that offer flexible hours, part-time options, or specific programs to cater to various needs, such as infant care, toddler programs, or after-school care, can capture a broader market and maximize occupancy rates. The ability to adapt and accommodate the evolving needs of parents sets apart successful childcare facilities from their competitors.

In the realm of commercial real estate, investors are captivated by a diverse range of opportunities. Prime retail spaces located in bustling commercial areas entice those seeking high foot traffic and a thriving consumer demand. The demand for sub-$5 million office spaces designed specifically for modern businesses, offering flexible environments and advanced amenities, is on the rise. Conveniently situated industrial properties, boasting modern warehousing facilities and efficient logistical systems, have become appealing to commercial investors. The allure of mixed-use developments, combining residential, commercial, and recreational spaces, lies in their potential to create integrated communities. Furthermore, sub-$5 million hospitality assets, including hotels and resorts nestled in popular tourist destinations, have garnered significant attention amidst the flourishing tourism industry.

To view the numbers visit Ray White Commercial they break this down further link here

)

)

)

)

)

)

)

)

)

)

)

)