)

Dividend Reinvestment Plan

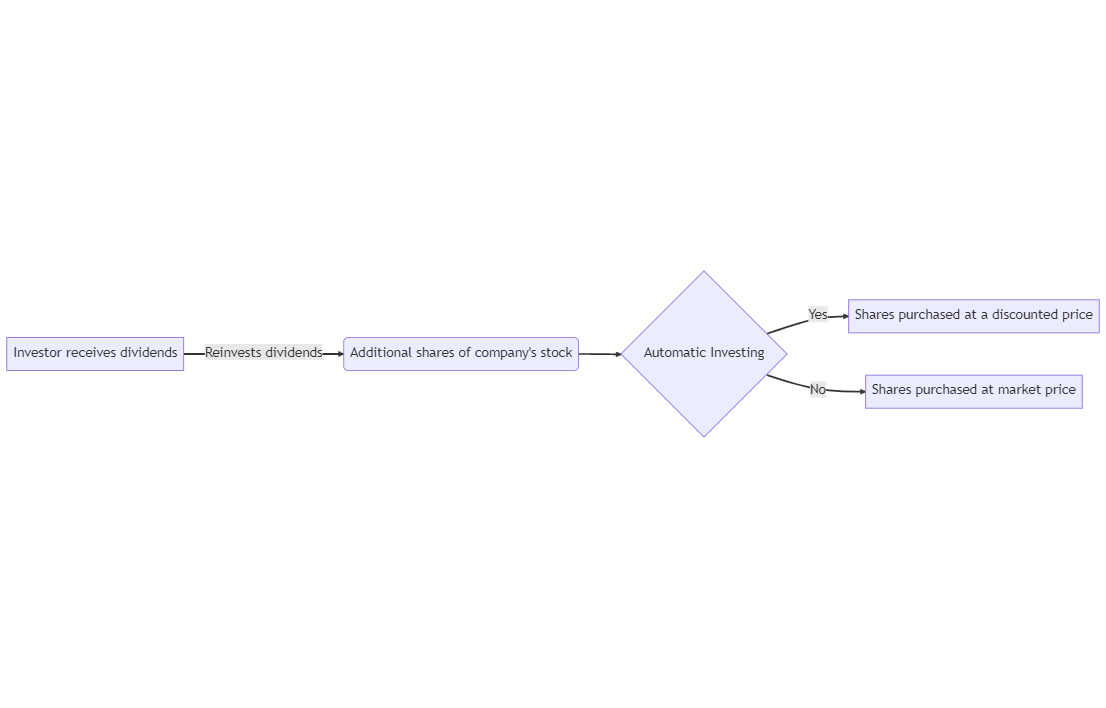

At Finexia, we recognize the significance of embracing Dividend Reinvestment Plans (DRIPs) as a strategic investment approach. DRIPs provide investors with a distinctive opportunity to reinvest their received dividends into additional shares of a company's stock, presenting the potential for substantial long-term gains. This article aims to delve into the concept of DRIPs, their mechanics, and the advantages associated with integrating them into an investment strategy.

What Constitutes a Dividend Reinvestment Plan (DRIP)?

A Dividend Reinvestment Plan, abbreviated as DRIP, is a program implemented by companies to empower investors to channel their cash dividends into additional shares of the company's stock. DRIPs stand out as a favoured avenue for long-term investors seeking to augment their investment portfolios without injecting additional capital. Typically, shares acquired through a DRIP come with a discounted price tag, enabling investors to optimize their returns over an extended period.

How Does a DRIP Work?

Upon enrolling in a DRIP, any cash dividends received from the company undergo automatic reinvestment in additional shares of the company's stock. This reinvestment usually transpires on a quarterly basis, though the frequency may vary among companies. Notably, shares procured through a DRIP often come at a discount compared to the prevailing market price, enabling investors to secure additional shares at a more favourable rate.

Advantages of Engaging in a DRIP:

1. Compound Interest: By reinvesting dividends, investors tap into the power of compound interest. This means that dividends earned are reinvested, potentially leading to substantial long-term gains.

2. Cost-Efficiency: DRIPs commonly offer shares at a discounted rate, allowing investors to acquire additional shares at a lower cost compared to the regular market price. This cost-saving aspect contributes to the overall efficiency of the investment.

3. Automated Investment: DRIPs facilitate the automatic reinvestment of dividends, freeing investors from the need for active management. This automation ensures a consistent investment approach over time.

4. Long-Term Portfolio Growth: Tailored for long-term investors, DRIPs provide a pathway for sustained portfolio growth. Through the continuous reinvestment of dividends, investors can harness the benefits of compound interest, potentially realizing significant returns over the extended investment horizon.

Embracing DRIPs aligns with a forward-looking investment strategy, and at Finexia, we are dedicated to guiding investors on leveraging such opportunities for long-term financial success.

Conclusion:

At Finexia, we believe that dividend reinvestment plans are an excellent way for investors to grow their investments over the long-term. By reinvesting their dividends, investors can take advantage of compound interest and potentially earn significant returns. If you're interested in learning more about dividend reinvestment plans, we encourage you to contact us to discuss your investment goals and strategies. Our Childcare Income Fund is designed with this in mind.

)

)

)

)

)

)

)

)

)

)

)

)